From 'Fortune': 5 Investing Bubbles

Investors have lived through the calamitous crashes of real estate and tech stocks in a single decade. You'd think we would have learned to avoid the sort of frenzied enthusiasm that causes an investing category to see its value inflated beyond all reason. Alas, that is almost certainly not the case.

Didier Sornette, who studies bubbles and is a professor at the Swiss Federal Institute of Technology, says low-interest-rate, low-return environments, where everyone is looking for safe havens (sound familiar?), are perfect for new investment manias. "This is a fantastic time for bubbles," says Sornette. "Right now there is not one bubble, but many, in our analysis." With a surprising quantity of investing categories looking excessively frothy, Fortune decided to examine some of the leading suspects -- and a few unexpected ones.

A decade-long boom has lifted many of China's 1.3 billion citizens out of poverty, spurring epic consumption and building. As a result, China's stock market has risen nearly 300% over the past 15 years.

Why it's worrisome

Much of that building and spending has been funded by debt. Last year Chinese banks made twice as many loans as they did in 2008, boosting lending by the equivalent of 29% of GDP. Housing prices continue to rise despite reports that 65 million dwellings in China are vacant.

Verdict: a bubble

Cracks appear to be slowly forming. China's stock market is down this year, and in July its manufacturing expanded at the slowest pace in 17 months. China's central bank has tightened its policies in an effort to rein in risky lending. Some savvy investors, including short-seller Jim Chanos, have turned bearish. Chanos said in April that China "is on a treadmill to hell."

At a time of economic uncertainty, investors want safety. U.S. Treasuries may no longer be viewed as impregnable, but they still inspire more confidence than, say, Greek government bonds.

Why they're worrisome

Why they're worrisome Supply is supposed to bring down prices, but that hasn't happened: U.S. bonds have risen 14% in 2010, even as the government has issued $3.3 trillion in debt over the past two years. "This is the big one," says Doug Noland, senior portfolio manager at the Federated Prudent Bear Fund. "Bubbles happen because there is no restraint on borrowing, and that's exactly the situation we have now for the federal government."

Verdict: not a bubble

The national debt is still a manageable 40% of GDP. Economists warn that growth will slow when it reaches 90% of GDP. The Congressional Budget Office projects it will take nine years to get to that level, and that's if Washington, which is debating the deficit, does nothing.

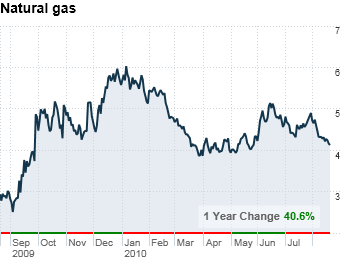

Shales, massive rock formations deep below ground, may hold enough natural gas to satisfy U.S. needs for the next 45 years. Pure-play shale companies such as Range Resources (RRC) and Southwestern Energy (SWN) have seen their stocks rise 72% and 160%, respectively, over the past five years.

Why they're worrisome

With gas prices already low -- $4.30 per million BTU -- these discoveries will add supply and further depress prices.

Verdict: a bubble

Environmental fears are fueling opposition to shale drilling. New York, where the massive Marcellus shale is partially located, is considering a temporary ban. Yet Range (a large Marcellus leaseholder) has a price/earnings ratio of 65 based on 2010 earnings, a huge premium to such diversified gas companies as Chesapeake and Devon, which have P/Es of 7 and 11, respectively. "Everyone is betting gas prices will go up," says Oppenheimer analyst Fadel Gheit. "But I don't see it."

Hold on to your shorts. Seriously -- they might be worth something. Cotton prices have nearly doubled in the past year to 80¢ a pound. The world has been using more but producing less. Last year's U.S. cotton production dropped to 12.2 million bales, the smallest crop in 20 years. And rising populations are causing nations like China and India to devote more land to foodstuffs and less to cotton.

Why it's worrisome

The two-year run has given farmers plenty of time to ramp up production, which means more cotton will soon be on the market and lower prices will follow. The USDA estimates that U.S. production will hit 18.6 million bales this year, up 50% from a year ago.

Verdict: a minor bubble

Analyst Sharon Johnson of First Capital Group says cotton has traded around 50¢ a pound for much of the past decade. When cotton has spiked above 80¢, it hasn't stayed there for long. "Prices are overvalued," she says.

Gold was rising even before the recession. But panic over world markets and the health of European and U.S. economies propelled it into the stratosphere. Prices have risen 150% in the past five years, repeatedly setting new records. Meanwhile, small investors have stormed in. Some fear that stimulus spending could lead to massive inflation; they believe a tangible material like gold will hold its value better than other assets.

Why it's worrisome

Inflation isn't rising. It's falling and likely to be restrained for some time by a tepid economy.

Verdict: a major bubble

Gold has already started slipping. It declined 6% in July to a recent $1,160 an ounce. Some economists are warning that continued weakness could lead to deflation. If that happens, expect gold to crater.